Retale:

- Businnes loan

- Cheque account

- Credit card

- Home loan

- Insurance advisor

- Mutual fund

- Personal loan

- Savings account

Wholesale:

- Capital Raising (Equity/ Debt/ Hybrids)

- Mezzanine finance

- Project finance

- Revolving credit

- Risk Managment (FX/ interest rates/ commodities/ derivates)

- Term loan

- CREDIT CARD: Small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services. Credit cards are issued by a credit card issuer, such as a bank or credit union, after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchants accepting that card.

2. TRANSACTIONAL ACCOUNT is a deposit account held at a bank or other financial institution, for the purpose of securely and quickly providing frequent access to funds on demand, through a variety of different channels.

All transactional accounts offer itemized lists of all financial transactions, either through a bank statement or a passbook. A transactional account allows the account holder to make or receive payments by:

- cash money (coins and banknotes)

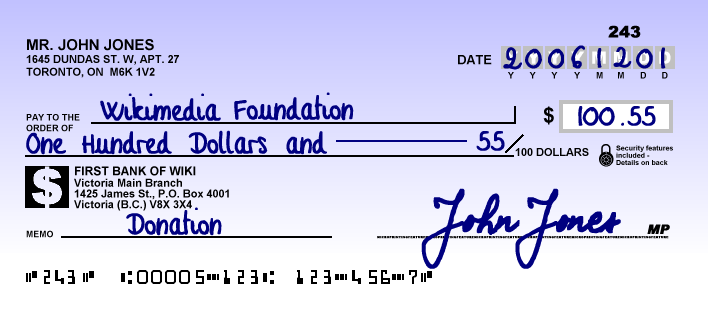

- cheque and money order (paper instruction to pay)

- giro (funds transfer, direct deposit)

- direct debit (pre-authorized debit)

- standing order (automatic funds transfer)

- ATM card or debit card (cashless direct payment at a store or merchant)

- SWIFT: International account to account transfer.

3. PROJECT FINANCE

The long term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of the project sponsors. Usually, a project financing structure involves a number of equity investors, known as sponsors, as well as a syndicate of banks that provide loans to the operation. The loans are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling.

ACTIVITY WEEK 2

ResponderEliminarplastic cards are very helpful when you use them to promote business or perform transactional activities....

ResponderEliminar